Lessons from a Correction

/For many investors, Monday felt like a slap in the face. Following news over the weekend of a oil price war between Saudi Arabia and Russia, the S&P500 traded down over 7% at the open. A move so swift, it actually triggered the 1st circuit breaker measure - a system put in place in 2013 to prevent these types of flash crashes. It’s a strange day when almost everyone can be heard discussing the markets. In the gym, in the line at the grocery store, in the lobby of my building, yesterday was one of those days.

The news regarding oil came to us in the middle of an already tense situation, the COVID 19 outbreak. The outbreak seems to have caused massive ripple affects across the globe. Closing some borders, borderline hysteria and a market sell off. The legitimate economic concern from the virus would be its disruption of the supply chain, a delay in production / productivity, ultimately leading to a halting or even declining of profits. That was the backdrop we were working with when the oil headlines broke. These two stories seemed to have a multiplier effect on one another, which led to the massive sell off experienced yesterday.

During moments like this, there are three bits of wisdom to keep in mind.

History is important.

During any moments of uncertainty it is important to give yourself a gut check. Yesterday was tough, and was a sobering reminder for many investors that the market does, in fact, move in both directions. Perhaps, though, yesterday felt even more violent due to the fact that the S&P500 has not dropped by more than 7.5% since October of 2008. It is interesting to note however that while yesterday’s selloff was intense, it was only the 19th worst. Remember when reading about these types of events, it is important to know whether you are reading data in points or percentage points. Sure, yesterday was the largest POINT drop for both the S&P & Dow, but of course it was. The market is trading higher than ever in history so the point moves are going to be larger. But in percentage terms, what actually matters, it was only the 19th worst.

2. This is why we diversify

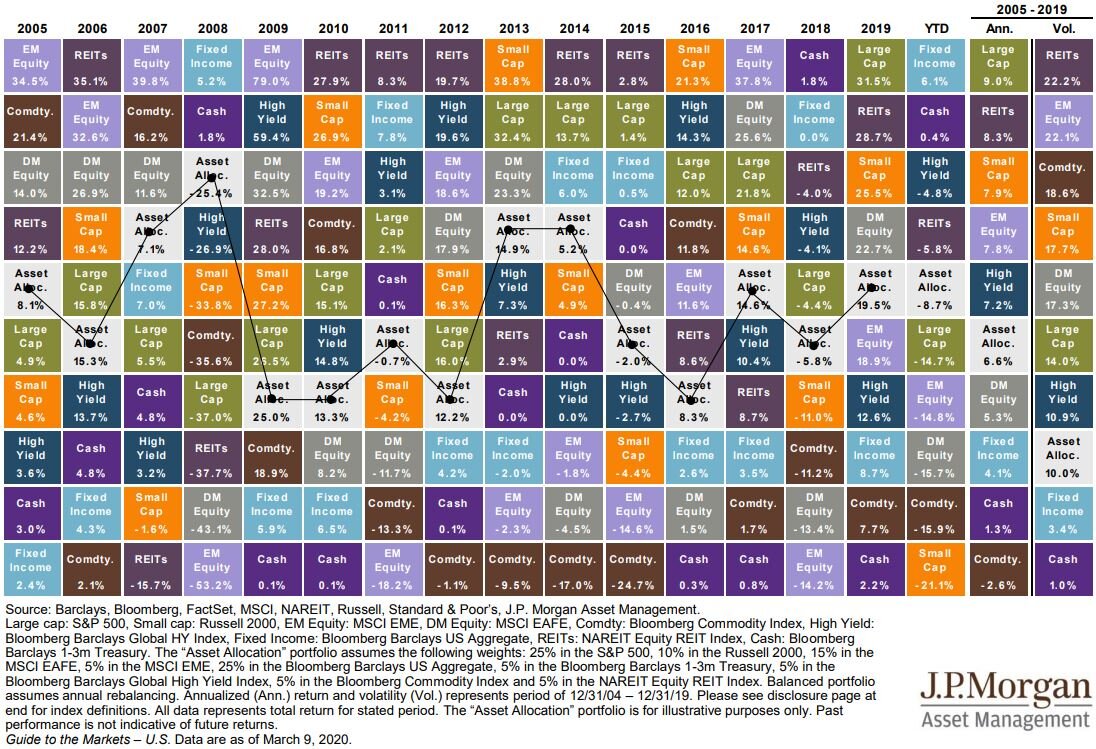

During periods of outperformance by any asset class, it is easy to wish you would’ve gone “all in.” We saw this last year when some US investors might have been frustrated that their diversified portfolios under performed the S&P500. In hindsight, it is understandable to feel like you missed out on some major gains in the “spirit of diversification” - but that is when things are going well. When it hits the fan - that is when you are sure glad that you are diversified. A portfolio diversified by both asset class and geography is not experiencing nearly the full brunt of this market correction.

3. Don’t do anything drastic

Right now, your 401k is like your face…do not touch it (@ryanbeckwith). This is a point I have tried to hammer home in my last few blog posts - but now is not the time to be making major knee jerk changes to your investment strategy. If you are a long term investor, especially in accounts like your 401k where you won’t be withdrawing the money until after 59 1/2, leave it alone. Investment changes during periods of a market downturn, or periods of uncertainty (both of which we are in) are typically short sighted and not beneficial in the long term.

Times like these are tough. Market volatility can be very unsettling, it can feel like lost progress. Behavioral finance tells us that we experience the “pain” of a loss in the market twice as much as we “enjoy” or celebrate a gain. I leave you with a piece of wisdom frequently said around our trading floor by our Chief Investment Strategist - “the good thing about bear markets is that they have never invented one that was permanent.” Stay patient, wait for news regarding the virus and the oil situation to play out. Focus on things that you can control, like your behavior and your attitude. Remember, market volatility is the price we pay to participate in market returns over time.

Stay calm, stay invested, and give us a call if you have any questions.

-James Chapman