Inflation Implications

/Inflation has been the hot button topic of the year. Seemingly every article, news segment, or social media post in regard to the market or economy will include at least some reference to inflation and the role it plays. Most of these references are about its effect on the consumer or how it has changed outlooks for various companies. What perhaps is lesser known, however, is the role CPI has in many government-stipulated figures such as Social Security benefits, qualified plan contribution limits, and income tax brackets. This article will focus on the various figures that are, in one way or another, tied to the CPI and its implications for American investors and retirees.

October’s Reading

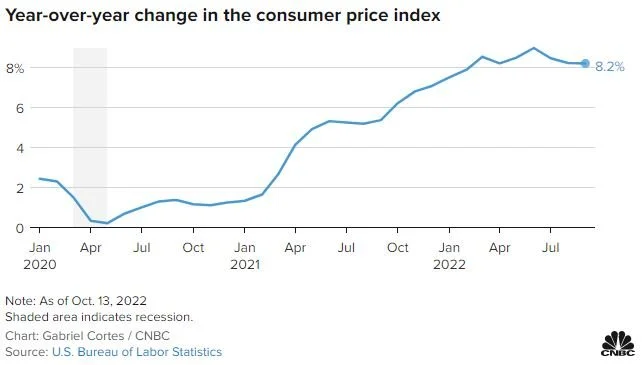

On Thursday, October 13th the U.S Bureau of Labor Statistics (BLS) data confirmed consumer prices rose 0.4% in September. This puts prices up 8.2% from a year ago. If you exclude food and energy, the Consumer Price Index (CPI) rose 0.6% or 6.6% year over year. This yearly gain on core (removing food and energy) is on pace for the highest since august of 1982. While October’s reading is below the peak number we saw in June, it is still hovering around the highest levels since the early 1980s.

Social Security Implications

Beginning in 1975, Social Security benefits have been “indexed to inflation” so that as the prices of goods / services increase over time, Social Security benefits adjust upward to accurately cover those types of expenses. These increases, referred to Cost of Living Adjustments (COLA’s), are tied to the CPI. Each October the Social Security Administration assesses and announces what the annual COLA will be. This year, on October 13th, it was announced that social security benefits will receive an 8.7% COLA. This increase represents the highest increase in 40 years. The last time the COLA was higher was in 1981 when the increase was 11.2%. The 8.7% increase will be reflected in Social Security benefits beginning in January. Takeaway: While this increase is indeed historically significant, it will not significantly benefit any of the 70 million Americans on Social Security or Supplemental Income. The move essentially translates into their ability to continue to tread water, a lateral move, rather than any tangible increase in actual benefits.

Qualified Plan Implications

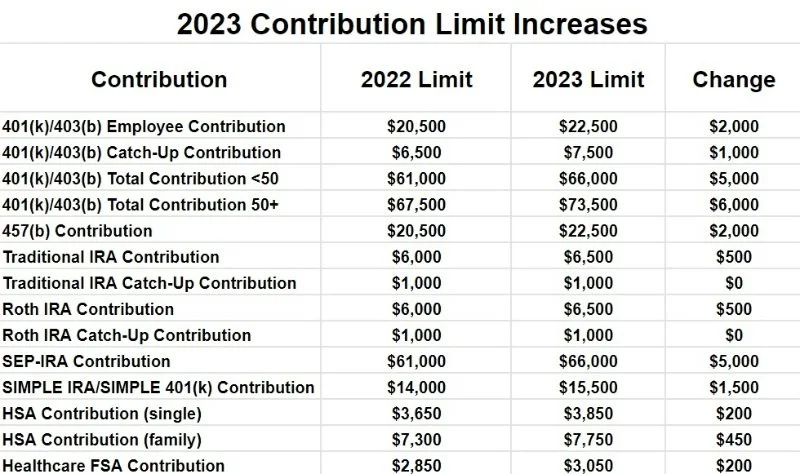

Another item that is tied to CPI is the federal limits to various contributions to qualified plans. Many of these amounts increased materially from 2022 to 2023 and retirement savers should be aware of their new higher limits.

Employees will now be able to contribute up to $22,500 to their employer 401k plans for 2023, up from $20,500 in 2022.

Employees over 50 have their 401k “catch up” provision increased to $7,500. Under the IRS’s defined contribution plan provision, employees will now have a total annual limit of $66,000 for 2023, up from 61,000 in 2022.

Americans contributing to Individual Retirement Accounts (IRA’s) have an increased limit of $6,500 for 2023, up from $6,000 in 2022.

For other contribution limit increases, see table to the right.

Tax implications

With formulas set by congress, the IRS has similar annual adjustments to figures that are very relevant to American taxpayers. Typically these adjustments are minor, but with inflation at 40-year highs the adjustments this year will actually be meaningful.

Beginning in 2023, individuals can transfer up to $12.92 million to heirs, during life or at death, without triggering a federal estate-tax bill, up from $12.06 million in 2022.

For couples electing portability, this translates into a combined limit of almost $26 million, an increase of almost $2 million from 2022.

Annual tax-free gifting limits have increased to $17,000 (per individual) up from $16,000 in 2022.

Standard Deduction - The standard deduction will increase by 7% in 2023. Marking it up to $27,700 for married couples and $13,850 for individuals. This is the largest increase since the standard deduction was first indexed to inflation in 1985.

Income tax brackets - income cut-off levels have also increased for 2023 for the various tax brackets. See the below table for the adjustments.

Source The oasis firm / irs

If you have questions about inflation, or its impact on any of the areas above, please contact your Clearwater Capital advisor.