Emerging Investment Themes for the Next Decade - Fintech

/The investment horizon is shifting. We are undergoing an unprecedented convergence of new technologies. Over the past century there have been some notable advances in technology that have redefined the way we live today. The telephone, the washer and dryer, the internet, etc. It is easy to point to past technological advances in hindsight and to wish you’d been able to get in early on the investment. New themes, however, are emerging. Themes that we believe have the potential to reshape our future in a way that makes the previous century seem sluggish in terms of advancement. These themes include but are not limited to fintech, human genomic sequencing, cyber security, clean water, the internet of things, robotics and AI, and cloud computing. This blog series will isolate each of these themes and serve as a sort of investment journal, containing what we see and what we are watching for each topic.

Part One - Fintech

Overview

Fintech is the abbreviation of “financial technology” and likely plays a bigger part in your current day-to-day life than you may even know. A company is said to be involved in fintech if it dedicates a significant portion of its operations to developing or offering products that are particularly innovative in the way our current financial system works. As such, these companies have the distinct opportunity to massively disrupt current financial operations and completely change the way these functions are conducted through their technology. Specific subcategories of fintech would include; payments, blockchain, risk transformation, funding, customer-facing platforms, and new intermediaries.

One of the original and most straightforward examples of fintech at work was the advent of the consumer-to-consumer transaction platform. This was largely born with Paypal, but today the names you likely think of are Venmo (owned by Paypal) and Cashapp (owned by Square). Venmo is no longer just an app that college kids use to send each other their portion of the bar tab, but has now crept into the lives of many consumers representing an increasingly large number of their weekly transactions. Take a scroll through the social feed of Venmo and you will see that this platform is being used by users to pay rent, for tennis lessons, clothing, utility bills, and yes…their bar tab. Between 2014 and 2020, digital payments increased by over 58%, growing to over $1T from $635B in 2014. Even still, the same study showed that only 11% of consumers indicated that they use digital wallets compared to the 84% who used credit cards, suggesting the penetration rate still has much room for improvement.

These platforms have revolutionized consumer-to-consumer transactions and have been embraced across many different demographics. More importantly, platforms like Square’s CashApp are now tapping into that user base and continue to develop capabilities like direct deposit, personal loans, and mortgages. The potential for this technology to almost obliterate the need for a standard bank on the corner of your local intersection is apparent.

Opportunities

In addition to some of the established and growing area’s of fintech, there are some less mature sub industries that are of particular interest. According to a study by the International Monetary Fund, Fintech represents just 6%, approximately $675 billion, of the total global estimated annual revenue for the financial services industry. Some of the most interesting opportunities within the Fintech space revolve around Buy Now Pay Later, digital wallets, and cloud enterprise solutions.

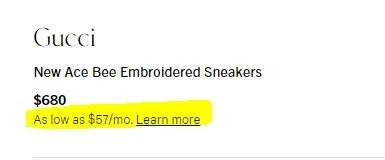

eXAMPLE OF AFTERPAY

Buy Now Pay Later services take direct aim at traditional credit based purchasing for potentially large transactions. At its most basic level, credit card companies provide a loan, or “credit,” to customers to buy a good / service on the premise that it will be paid back over time. While not the most prudent financial planning measure, large purchases are sometimes put on a credit card if no other liquidity options exist. Need a new refrigerator or water heater? “Put it on the credit card…” Buy Now Pay Later, BNPL, allows a customer to purchase an item on a pre-determined installment sale. Acting similar to a traditional loan, the customer would complete a simple credit app and pay a down payment and installments over several weeks or months thereafter. You may have seen services like this advertised on luxury goods websites. Unlike traditional credit cards, BNPL often features 0% APRs. Late or missed payments can result in fees and credit score dings. According to a study done by Apexx, consumers are likely to spend 10-40% more when they use a BNPL service rather than a credit card. This can result in higher overall sales and conversion rates for retailers. BNPL transactions still represent a very small percentage of domestic purchases, but if they were to take similar trajectories that they have overseas could have 10x growth opportunities.

Digital Wallets are a logical complement to the overall payments / fintech space. With the increasing adoption of cryptocurrency investing, the accessibility to the average investor / consumer is something to pay attention to. Though getting easier and easier, for much of the very early days of cryptocurrency investing only the “technologically savvy” types were the ones who actually knew how to do it. Now, it is more common to see cryptocurrency investing available on popular apps like CashApp and Paypal, enabling consumers to have crypto assets right next to their traditional cash accounts. This innovation has also helped solve the classic cryptocurrency question, how can you actually buy goods / services with it? For Paypal, they facilitate a cryptocurrency purchase transaction that is immediately converted and settled in fiat currency. The ease / accessibility of crypto will be a major tipping point for its adoption.

Cloud Banking is the third subset of fintech opportunities that stands at the edge of mass adoption. On an increasing basis, the need to visit a traditional bank branch is becoming less of a necessity and more of an inconvenience. Even before COVID, think about the last time you had to visit a traditional bank branch and what a, likely, poor experience it was. Fintech is traditionally thought of as a disruptor to the traditional bank experience, but that may not be fair. While, to a degree that is likely to be true, what if certain elements of fintech actually were able to enhance the overall traditional banking experience? According to a Gartner report, banks are expected to increase investment on enterprise software solutions by 11%, up to $112 Billion in 2021. Cloud banking represents not only an opportunity for new, digital-only players, but has the potential for traditional banks to digitize and improve their offerings.

Breakthrough Points

The opportunities that exist in the fintech space are wide and apparent. But, what are some of the contingencies on the horizon to keep an eye on?

Further implementation of flexible payment options. While COVID accelerated much of this where, for example, even local dining establishments may offer touchless (digital) payment options, there is still a large opportunity for the adoption of various payments to widen. To illustrate, Starbucks may be the poster child for how this could look. On their website, acceptable forms of payment include Starbucks Cards, Apple Pay, Google Pay, PayPal, Bakkt Cash, Credit, or….cash. Listed in that order! But perhaps more importantly what they have done is offer these various payment option in a consistently convenient, secure, and usable way. That will be the standard going forward for how companies will need to offer payment flexibility for an increasing number of options and preferences.

Increased Consumer Comfort. As stated at the beginning of this article, most consumers’ introduction to “fintech” was mobile money movements to pay a friend or perhaps send money to a child for something. The increasing breadth of fintech will rely on an increasing comfort from the consumer on not only conducting various financial tasks virtually but also from companies they don’t recognize from every intersection in their town. It is one thing to send $20 to a colleague for lunch, but its an entirely different thing to apply for a home mortgage through an entirely digital firm. As the security, user experience, and simplicity continues to improve for each of these fintech offerings, we hope to also see consumer willingness move in lock step.

Regulatory catch-up. In some areas more obvious than others, governmental regulation and rulings will ultimately be required and perhaps be one of the final hinge points of fintech’s overall adoption. While some fintech offerings essentially just digitize an existing, compliant financial offering, some area’s such as crypto are completely new. Regulators and courts have recently put increasing scrutiny on initial coin offerings (ICO’s) to ensure that proper measures are being taken in order to protect investors from this new wild west of cryptocurrencies. It remains to be seen how they will react and accommodate an increasingly digital financial world.

Conclusion

Fintech has evolved in 2 major ways. First, it is no longer solely limited to the payments industry. While the payments industry, whether peer to peer or consumer, still does represent a majority of the associated names, the space has evolved into so much more. Digital banking, peer-to-peer lending, digital wallets, crowdfunding all represent areas of Fintech that are on the horizon in this ever-changing world. Second, and very related to the first point, no longer is fintech simply seen as a pure threat to traditional financial institutions. I remember sitting at a conference in NYC about 7 years ago in a session about “robo advising.” I remember the mood of the room was all these financial advisors afraid of how these so-called robo advisors would completely put them out of business and end up eating their lunch. Today, at least for the innovative firms that weren’t afraid to embrace new technologies, much of the very technology that was being discussed during that conference has been implemented to ENHANCE our client experience, not cannibalize it. This trend is apparent in many of the subsets of the fintech space and overall will lead to the success of the sub asset class.